Our websites use cookies. By continuing, we assume your permission to deploy cookies as detailed in our Privacy Policy.

Best Payment Methods of All Time for Your eCommerce Store

The eCommerce industry has grown extraordinarily in the past decade. Since it has advantages like saving time, providing access to better product alternatives, and simplifying the buying process without even leaving your home, millions of people have started to choose online shopping over in-store shopping. The merchants are very well aware of this great potential for sales and want to make the most of it. Therefore, the number of online stores is increasing rapidly. But how can you differentiate from thousands of eCommerce businesses and come forward as the forerunner? The best way to do so is to give the best shopping experience to your website visitors. The user experience must be smooth and straightforward.

Check-out is an essential step of your sales funnels since the conversion, your business’ whole aim, happens at this stage. It is where you get paid, and the visitors finally become your customers. To enhance sales opportunities at this step, making your customers’ buying experience as effortless as possible is crucial. That is why you should offer simple, safe and diverse payment methods on your eCommerce store.

Key Takeaways

- Consider your target audience’s needs and habits when deciding which payment methods to offer since habits differ across different cultures, countries, continents, and demographics.

- Offering a selection of different modes of payment online will help you avoid high cart abandonment rates.

- Security is the primary consideration for 44% of customers when choosing an online payment method. (Paysafe, Consumer Payment Trends 2022)

Why Should You Offer Different Payment Methods?

For eCommerce businesses, cart abandonments and lost revenues can be avoided by offering customers a list of payment methods they want to use or are accustomed to. There were few options in the past; most online payments were made through money orders, cheques, or bank deposits. But today, with our advanced technologies, there are various modes of online payments that shoppers can use.

To cater to a wide range of customer bases and earn more conversions, allowing all to choose their preferred mode of payment online is critical. Since the different payment systems have distinctive charge rates and unique mechanisms to make payments, they can influence different groups of customers.

Delivering alternative payment services will let you merchandise to mixed demographic groups in various geographic regions and have the largest target audience possible. Working with different companies and offering their products as your eCommerce store’s payment methods will also help increase the awareness and trust in your brand.

How to Choose the Best Payment Method for Your eCommerce Store?

The eCommerce industry is flooded with many eCommerce payment services; it may be frustrating to choose how you accept online payments. Before you decide which electronic payment methods to offer, you should define your target audience.

With the variety of your customers, the local, geographical, or cultural shopping habits may differ, and how they respond to different payment technologies can change. Providing payment systems that your audience doesn’t trust or is not interested in may cause you to lose sales. But again, if your eCommerce store lacks the proper range of online payment systems, it can lead your potential customers to abandon their carts and leave your website mid-checkout.

It would help your business remarkably if you offered different uncomplicated options that best suit your target audience, allowing them to shop at peace and complete their purchases. You must first analyse what your audience expects and define your business niche. Then you should evaluate different methods of electronic payments to find the ones that best suit your business’s requirements.

What are the Most Popular Payment Methods in eCommerce?

If you have an internationally operating eCommerce store, the most frequently used types of payments will be credit and debit card payments. However, there are plenty of other payment methods which may be used at different rates in different parts of the world.

For example, while cash is the most popular payment method in India, it is not widely preferred in Europe. Here are the most commonly used payment systems in eCommerce worldwide:

1. Credit Card Payment

Credit cards are the most commonly used payment method in eCommerce. Since credit cards are easy and mostly safe to use, the high popularity of using them in online purchases is no surprise. Shoppers only need to enter their card details to finish buying the products at the checkout.

CVV, short for Card Verification Value, is what makes credit cards more secure. Businesses can detect fraud by comparing cardholders’ information and CVV numbers.

Besides being simple to use, shoppers use a credit card also to make use of its extra features, such as discounts and reward programs. Additionally, they can benefit from credit card usage in credit scoring.

All these advantages ensure credit card payments still take the lead, despite having countless more innovative competitors. As you probably heard their names, some of the most popular, internationally used credit cards are American Express, Visa, and MasterCard.

2. Debit Card Payment

Debit Cards are also widely used worldwide, and using them for online purchases is a close second to credit cards as the most commonly used online payment method. While the process of purchasing is the same, debit card payments permit users only to use their savings in the connected bank account. On the other hand, credit card payments are made at the end of the billing period, way after the purchase is made.

As a result, shoppers who use credit cards tend to spend more than they can pay. Hence, debit cards can be a better choice for people who have lower financial limits and don’t want to exceed them.

3. Bank Transfer

One of the most secure payment methods is Bank Transfers when it comes to online shopping. Since it may cause online shoppers to fall into swindlers’ hands, people tend to be hesitant while making payments on eCommerce stores; some even don’t want to enter their credit/debit card credentials.

Most people prefer to use credit/debit cards, so bank transfers are slowly going out of fashion despite being considered safer. Bank transfers are considered safer because the transactions need to be approved by the customers, meaning they have to authenticate and verify each purchase from their online bank accounts. Correspondingly, bank transfers make the shopping experience much longer and slower.

4. Direct Deposit

Using Direct Deposit, as its name indicates, allows buyers to transfer the charges to the sellers’ accounts directly. With direct debit mandates, users can send requests to their banks to authorise regular payments.

By eliminating the risk of theft or loss, they can be a safer payment method, especially for non-eCommerce purchases. Moreover, no intermediary is needed; thus, it is a fast way to transfer money.

Direct Deposit payments are most commonly used to schedule recurring expenses such as salary payments for businesses or subscription-based fees for individuals. Even though it may lose its popularity to innovative solutions, it will always remain an acceptable payment method.

5. Cash on Delivery (COD)

Cards have an advantage in terms of online payments. Cash, a physical item in a virtual world, is becoming an undesirable payment method as many innovative competitors arise. Yet, it remains important in some areas, especially in developing countries like Brazil, Mexico, and India.

eCommerce shoppers use this method for cash-on-delivery transactions. However, it should be noted that it can be risky to pay with cash because some cash-on-delivery providers may send you invoices later than you pay them, and you cannot always be sure if the billing is made rightfully. But then, paying with cash is convenient for those not using any cards.

6. App Payments

As the eCommerce industry grew, big tech companies wanted to get the most share of the cake. Facebook, initially being only a social media platform, lacked online store features. Considering its impact and its branches, Instagram and WhatsApp, it was a huge opportunity loss not being able to sell to their users.

In the past few years, we saw that this loss was successfully cleared up with the rise of social commerce. By adding marketplaces and allowing users to buy products on the apps without having to leave, Facebook ventured into the world of social commerce.

Then in the following years, we’ve all had first-hand experience in the development of social commerce. Instagram, TikTok, Pinterest, Twitter, and many other social media platforms are no longer mere socialising tools.

Tiktok is especially the hottest thing in the eCommerce world right now. Check out TikTok Marketing Strategy Tips for a more in-depth discussion about TikTok and eCommerce.

7. Electronic Checks

Electronic Checks, or E-Checks, in short, have practically the same process in use as standard paper checks, but since they can be processed online, the challenges time and place may cause are eliminated, making e-checks much faster.

Using e-checks allows shoppers to authorise payments directly from their online bank accounts. E-checks were the first payment method for online shopping in North America and still is a popular option while also widely used in Europe. Aside from their ease of use, extra-low charges make e-checks a better and more affordable payment method for larger sale volumes.

8. Cryptocurrency

Increasing their popularity day by day, cryptocurrencies are no longer the money for the future; they are now commonly known and create new areas to be used worldwide. Not only Bitcoin but also tens of new altcoins are exchanged every day.

In the past decade, they got popular among digital merchants as there were no chargebacks or taxes. With the expansion in cryptocurrency transactions, governments and large businesses started to interfere and establish some regulations; however, this payment method still has the lowest fees in the market. Despite the risks of ever-changing monetary value and uncertainty of future governments’ approaches to coins, they are still promising for online payments.

9. Electronic Wallets

Electronic Wallets, also named E-Wallets or Digital Wallets, allow online shoppers to purchase products faster and smoother. Because only one or two clicks are enough to complete a payment, the shopping experience can be done within seconds.

E-Wallets work as storage for both the shoppers’ information and the funds. After linking their bank account to an e-wallet, if the users choose to pay online with their e-wallets, they will be directed to the e-wallet page, and entering their password will be enough to finalise the purchase.

By eliminating the need to enter your credentials and credit/debit card information each time you want to buy something online, e-wallets are becoming highly favourable for people. The most popular e-wallets like Amazon Pay, Apple Pay, Google Pay, Samsung Pay, and AliPay are already thriving among the different modes of payment online.

10. Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) systems are initially short-term loans offered to customers at the point of purchase. Such systems, as their name suggests, allow customers to make the purchase and pay at a later time, often interest-free.

BNPL services work just like credit cards, as in not having to pay at the time of purchase. But, of course, the customer does not have to have a credit card to use these services.

Also referred to as “point of sale instalment loans”, BNPL systems are becoming increasingly popular. Younger generations like Millennials and Gen Z are especially fans of this mode of payment online. According to Klarna, BNPL is also gaining the merchants’ favour: They experience an increase of around 45% in their Average Order Value (AOV).

Other than Klarna, the most popular BNPL services are Shop Pay Installments by Shopify, Affirm, Afterpay and Sezzle. PayPal has introduced its own BNPL service as well.

11. eCommerce Payment Gateways

Payment gateways are eCommerce businesses’ services for shoppers, which process credit/debit card payments. The first examples of payment gateways were the native systems that individual eCommerce services designed. When the number of eCommerce stores and online shoppers ascended, these native systems had to convert into more standardised platforms for more merchants to use them simultaneously.

Today, the eCommerce industry is filled with a vast range of payment gateway providers that generate fast and secure links between shoppers, merchants, and banks. Since the competition is hot, it may be costly initially. Still, even if the cost of implementing and holding them on your website is high, the return on investment will most likely be satisfactory. There are tens of great payment gateways like PayPal, Square, and Stripe, and more businesses are coming up with new ones day after day.

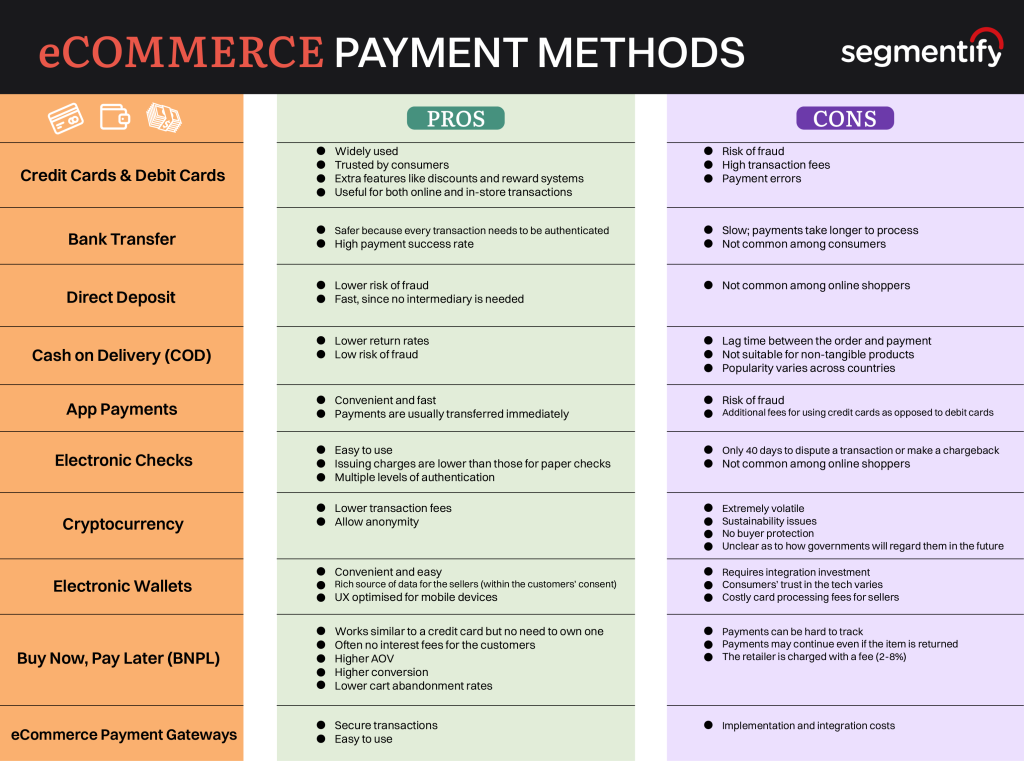

12. Infographic: Comparing the Most Popular Payment Methods in eCommerce

What is a Payment Gateway?

Payment Gateways have become a regular part of the eCommerce industry, and various companies provide these services and integrate their solutions into your eCommerce store. Payment gateway providers, also known as payment service/solution providers or payment processors, offer these virtual gateways for merchants and shoppers. They connect them with the necessary third parties – usually the banks – while handling the transactions.

Digital payment gateways, more commonly called eCommerce payment gateways, are the services that process the users’ payment information and generate links to allow them to complete their purchases. After you sign up and integrate a payment gateway tool, you, as a business owner, will only need to wait for the payment processors to deposit the purchases in your merchant account.

How Does a Payment Gateway Work?

The workflow of a payment gateway actually involves a lot of steps, but thanks to the advancements in technology, it takes mere seconds:

1. The customer inputs payment information and initiates the purchase, e.g. presses the “Order Now” button.

2. The payment gateway performs fraud checks and ensures that the transaction doesn’t exceed the customer’s credit limit or that they have enough funds.

3. The encrypted card information is sent to the card schemes (Visa, MasterCard) to process the transaction, which perform another fraud check.

4. The payment gateway approves the transaction and sends the information back to the website to complete the transaction.

5. The payment gateway sends information to the acquiring bank to move the money from the issuing bank (customer) to the retailer’s bank account.

What are the Best Payment Gateway Tools?

You can select one or more payment gateways to serve you and your customers. Before choosing suitable gateways for your business, you should do your research well. Here is some crucial information about some of the best eCommerce payment gateways:

1. Stripe

Regarding versatility, Stripe is a good option in your online store as it provides a feature-rich payment gate. It enables various payment options while accepting payments from a wide range of sources. Also, its simplicity while integration is another reason that makes it popular. If you and your team have limited skills in coding, you can benefit from using Stripe with only a single line of JavaScript on your site.

Pricing: Stripe has two options available, integrated and customised. While you have to get in touch with their Sales Team to get information about pricing for the latter, the integrated version uses a pay-as-you-go pricing model, which charges 2.9% + 30¢ per successful card charge.

2. Due

Being among the lowest-priced gateway operators in the market with its flat-rate fee structure, Due is an advantageous option for both the eCommerce store owners and their shoppers. Smaller-sized businesses and even freelancers who offer their products and services online can benefit from it.

Pricing: Due has two pricing models, free and $10/month. The premium model offers additional services such as 24/7 support, monthly account statement and advanced tax planning access.

3. Square

Square is also widely popular for offline in-person payment as well as its eCommerce options. It may be a little pricey compared to other payment gateways; however, it can be a great option if you have both physical stores and an eCommerce business with reliable POS systems and online alternatives. They also have an easy checkout solution that allows shoppers to set up profiles while providing payment information.

Pricing: Square offers three different pricing models: free, plus and premium. The free model does not have a subscription fee; instead only involves processing fees. In comparison, the premium model involves advanced features for restaurants, retailers, or appointment-based businesses and costs $29/month, plus processing fees. The pricing for the premium model is based on the customer’s organisational and more complex needs.

4. Adyen

Offering a full range of online payment options, Adyen is an excellent option to have as a payment gateway on your website to give your customers better shopping experiences. It has a fraud protection feature working with AI and a rule-based risk ecosystem, making it a secure gateway you can easily trust. Additionally, with its payment-linked data process, it is easy to apply discounts, rewards, and one-click payments.

Pricing: For each transaction, Adyen charges a fixed processing fee (€0.10) plus a fee determined by the payment method.

5. PayPal

PayPal is the most known payment gateway of all payment options and has over 250 million users worldwide. Your customers will probably expect this familiar option while purchasing products online and feel safer using it. Having a high cost per purchase can be challenging for small businesses to integrate it. But using PayPal converts at significantly higher rates than with any other options, so it should be considered.

Pricing: PayPal charges different fixed processing fees plus transactional fees based on the selected payment method.

6. Authorize.net

Authorize.net is a good option because of its versatile choice of plans for both small and bigger businesses. It supports a wide range of currencies, all major cards and digital wallets. It accepts all transactions made by shoppers worldwide; however, to integrate it on your website, your business must be registered in Canada, Europe, Australia, the US, or the UK. Authorize.net also offers a merchant account and fast transfers.

Pricing: Authorize.net offers two different pricing plans with the same fixed monthly fee. The pricing per transaction differs depending on the plan.

7. 2checkout (Verifone)

US-based 2checkout, or Verifone as it is now called, is a payment gateway getting popular with its variety of services. It supports 87 currencies and 15 languages, making it very useful for globally operating eCommerce businesses. Also, it is a reliable option to have on your website, allowing integration with more than 100 online payment systems.

Pricing: Verifone offers three different pricing plans for three different business models: businesses wanting to sell globally, subscription-based businesses and businesses selling digital goods globally.

8. Skrill

Being a globally known payment gateway, Skrill is one of the best options to offer on your website. It is also an awarded solution with its innovative features. Skrill supports over 30 currencies and enables eCommerce customers to purchase comfortably worldwide. Also, offering a free account to its users sure is a handy option.

Pricing: Skrill offers different pricing that best fits the retailer’s business model.

9. Amazon Pay

As one of the, if not the most, well-known online retail platforms, Amazon has been offering its customers its online payment processing service, Amazon Pay, since 2007. Amazon Pay lets retailers offer their customers easy, secure and fast payment using the shipping and payment information linked to their Amazon accounts, therefore, saving customers from the inconvenience of entering new information on the retailer’s website.

Pricing: Amazon Pay offers different pricing models for operations of various sizes.

10. checkout.com

Checkout.com is an international fintech company that processes different online payment modes across various currencies. Easy to integrate with your website, checkout.com is a convenient tool if you wish to grow your business into new markets and regions, as they help you tailor your solution for each market with their local insights and knowledge.

Pricing: The pricing structure of checkout.com depends on multiple factors, such as card type, retailer’s location, and the consumer’s issuing bank, with fees passed directly to the retailer.

Why Should You Use Payment Gateways for Your eCommerce Store?

As you can see, there are many payment gateways that you can use for your eCommerce business with a variety of distinct features.

- These gateways will speed up your shoppers’ buying process with quick transmissions and one-tap solutions, which will decrease last-minute decision changes and cart abandonment rates.

- Since security is one of the biggest concerns for online shoppers, providing them with encrypted and secure gateways will relieve them of the stress of being defrauded.

- With lower or no charges compared to other payment methods, the payment gateways will also be a preferable system for your customers.

There is no doubt the payment gateways will ease the purchase process and have high success rates, returning you with increased sales and conversion rates.

Wrapping Up

To have a large customer base, you must ensure your eCommerce store is convenient for all of them. People don’t have the same preferences when it comes to purchasing online. Your responsibilities include being aware of your target audience’s needs and desires in payment methods and offering them suitable options.

Today, online shopping is easier for both the retailer and the shoppers, thanks to technological advancements and the significant number of payment methods. It will be better for your business to offer as many alternative payment options as possible to have more sales and increase your conversion rates. That is why you should consider adding the payment methods we have mentioned to your eCommerce store and improving your customers’ online shopping experience.